Get Low-Interest Unsecured Business Lines of Credit with an 80 Paydex

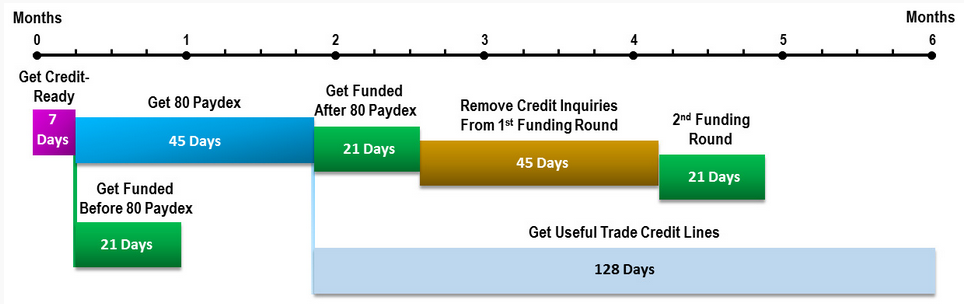

We here at Corporate Cash Credit understand that bad things sometimes happen to good companies, and that’s why we have designed a program to help. For businesses owners who are looking for unsecured business lines of credit but don’t quite have the Paydex score to back up their goals, CorporateCashCredit.com has solutions. Your Paydex score reflects your ability to repay creditors on time, but it’s not always an accurate picture of your creditworthiness. Still, it plays a huge role in your eligibility for any kind of corporate financing. We can get you that coveted 80 Paydex quickly and then fast-track your application for unsecured business lines of creditor trade credit so you can get on with your life as a successful business owner.

Get Help from the Pros When Applying for Unsecured Business Lines of Credit

At Corporate Cash Credit, we know how the game is played. We understand that opportunities only come knocking for a limited time and that you need to apply for unsecured business lines of credit as soon as possible. By getting you credit-ready in a timely manner, our team of experts can help you get the attention of the most promising lenders and suppliers, ensuring your approvals on low-interest unsecured business loans and even trade credit accounts. Rest assured that you will be getting unsecured funding through a professional and efficient source when you choose CorporateCashCredit.com to get your business credit-ready with an impressive 80 Paydex.

Apply for Unsecured Business Lines of Credit through Promising Sources

Not only do we help you get credit-ready before you start applying for unsecured business lines of credit, but we also do everything in our power to get you approved when you finally feel confident enough to submit your first application. We do all the paperwork for you, and we actually have access to a large network of reputable lenders – each of which is willing and able to offer you as much as $50,000 in unsecured business lines of credit using minimal documentation. We can help you to improve your business and turn it into a lasting industry icon, by providing you with cumulative funding opportunities that are easy to get.

Make the Most of Your Time and Money when Applying for Unsecured Business Lines of Credit

Time is of the essence when you are running a lucrative business, and that is precisely why you need to act fast and get credit-ready right away. Luckily, CorporateCashCredit.com can help you achieve an 80 Paydex using a quick 45-day process. Our flat fee of just $1,999 is incredibly competitive too, especially considering the scope of our comprehensive services. Be sure to visit CorporateCashCredit.com right away to have your credit analyzed by an expert. If you need help applying for unsecured business lines of credit, we have the tools and the knowledge to get it done quickly – starting now.